Ethereum Price Prediction: How High Will ETH Go Amid Institutional Surge?

#ETH

- Technical Breakout Potential: ETH price approaches Bollinger upper band with improving MACD

- Institutional Demand Surge: $1.65B monthly inflows from corporate treasuries

- Supply Shock Catalyst: SharpLink Gaming and others removing 310K+ ETH from circulation

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

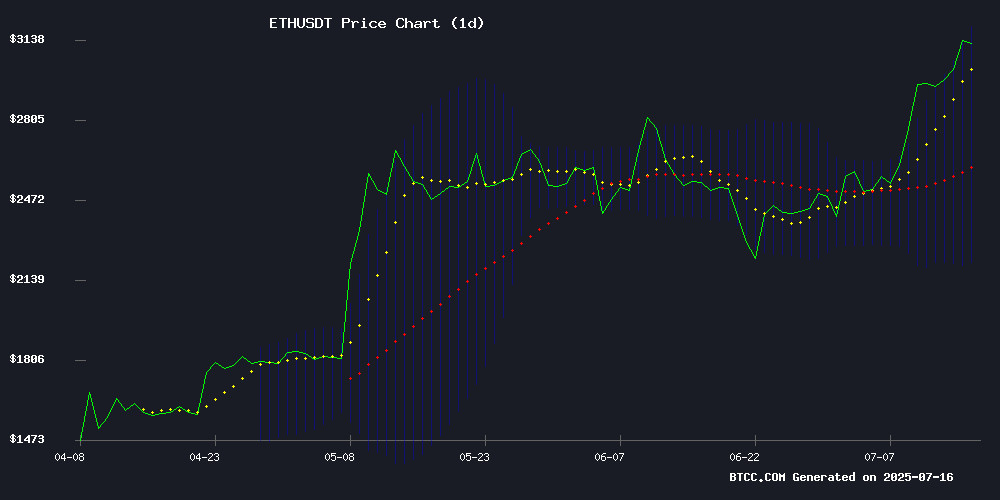

Ethereum (ETH) is currently trading at $3,179.11, showing strong momentum above its 20-day moving average (MA) of $2,704.38. The MACD indicator (-272.25 | -173.12 | -99.13) remains in negative territory but is converging, suggesting weakening bearish momentum. Bollinger Bands indicate volatility with the upper band at $3,205.29 and lower band at $2,203.46, while the price sits NEAR the upper range—a bullish signal.

"ETH's consolidation above key technical levels, coupled with improving MACD, hints at potential upside," says BTCC financial analyst Sophia. "A sustained break above $3,200 could trigger a new rally phase."

Institutional Frenzy Fuels Ethereum Optimism

Corporate ethereum holdings are making headlines as SharpLink Gaming surpasses the Ethereum Foundation with 310,000 ETH. Peter Thiel's Founders Fund invested in BitMine, while BTCS Inc. added $44M worth of ETH—signaling institutional confidence. "The $1.65B monthly institutional demand is reshaping ETH's supply dynamics," notes BTCC's Sophia. "This institutional FOMO could propel prices higher as treasury strategies go mainstream."

Factors Influencing ETH’s Price

SharpLink Gaming Surpasses Ethereum Foundation as Largest Corporate ETH Holder

SharpLink Gaming has emerged as the world's largest corporate holder of Ethereum, amassing 280,706 ETH—surpassing the ethereum Foundation's 241,000 ETH reserve. The sports betting affiliate giant acquired 74,656 ETH last week at an average price of $2,852, funded by a $413 million capital raise from share sales.

Tom Lee of Fundstrat forecasts a potential ETH breakout above $4,000 by late 2025. SharpLink's aggressive accumulation strategy, chaired by Ethereum co-founder Joseph Lubin, targets a $1 billion ETH treasury. The firm has already staked 99.7% of its holdings, generating 415 ETH in yield.

With $257 million remaining in its war chest and $153 million in unrealized gains, SharpLink's MOVE signals growing institutional conviction in Ethereum's long-term value proposition. The gaming company's treasury now represents 0.23% of ETH's circulating supply.

Peter Thiel's Founders Fund Acquires 9.1% Stake in Ethereum-Focused BitMine, Sparking 12% Stock Surge

Peter Thiel's Founders Fund has taken a 9.1% position in BitMine Immersion Technologies (BMNR), according to SEC filings. The venture capital firm purchased 5.09 million shares across multiple entities, triggering a 12% pre-market rally in BMNR stock to $44.97.

The move aligns BitMine with institutional heavyweights Pantera, Galaxy, and Kraken Exchange, all of whom have invested in the Ethereum-focused firm. BitMine recently raised $250 million through private placement to establish an ETH treasury, now holding over 163,000 ETH worth $500 million.

Analysts suggest the investment signals growing institutional conviction in Ethereum's treasury potential. Fundstrat co-founder Tom Lee, appointed as BitMine's Chairman in June, lends further credibility to the venture.

SharpLink Gaming Ethereum Holdings Surge, What’s Next for ETH?

SharpLink Gaming's Ethereum holdings have surged to $700 million, positioning the company as the largest corporate holder of ETH—even surpassing the Ethereum Foundation. This strategic accumulation follows the organization's recent staking activities, signaling strong institutional confidence in Ethereum's long-term value.

The move underscores growing corporate adoption of digital assets, with SharpLink's bet on ETH reflecting broader market trends toward institutional crypto investment. Such sizable holdings often precede increased market liquidity and potential price stabilization.

Tom Lee Predicts Major Upside for Ethereum Amid Stablecoin Boom and Wall Street Adoption

Ethereum has surged 22% over the past month, reaching a five-month high, yet remains 10% down year-to-date. Fundstrat's Tom Lee argues the tide is turning. Stablecoin proliferation and institutional tokenization of real-world assets are creating structural demand for ETH—potentially propelling it beyond its 2021 all-time high of $4,880 within years.

Transaction activity on the Ethereum network shows renewed momentum, notes Fundstrat's Head of Digital Assets Sean Farrell. The impending Federal Reserve rate cuts could further catalyze ETH's rally by injecting liquidity into risk assets. Meanwhile, PayPal co-founder Peter Thiel's 9.1% stake in Lee's BitMine underscores growing institutional conviction in Ethereum's treasury narrative.

SharpLink Expands Ethereum Holdings to Over 310,000 ETH Amid Buying Spree

SharpLink, a Nasdaq-listed sports-tech firm, has aggressively expanded its Ethereum portfolio, acquiring an additional 6,377 ETH this week worth approximately $19.56 million. This latest purchase elevates the company's total holdings to nearly 312,000 ETH, valued at roughly $974 million based on current prices.

The buying frenzy includes a 24,371 ETH acquisition on July 15 and a 74,656 ETH purchase between July 7 and July 13, totaling $275 million in just seven days. Notably, SharpLink sourced 10,000 ETH directly from the Ethereum Foundation, signaling strategic intent.

Transactions have been routed through major centralized exchanges and over-the-counter addresses, suggesting a long-term bullish stance. Market observers speculate the accumulation aligns with anticipated Ethereum protocol upgrades or institutional adoption trends.

GameSquare to Detail $100 Million Ethereum Treasury Strategy in Upcoming Call

GameSquare Holdings, Inc. (NASDAQ: GAME) will host a conference call on July 16, 2025, to elaborate on its $100 million Ethereum treasury strategy. CEO Justin Kenna, alongside Dialectic AG founder Ryan Zurrer and Goff Capital's Rhydon Lee, will outline a proprietary ETH yield strategy designed to enhance shareholder value.

The initiative follows a successful capital raise, positioning the treasury management program as both a balance sheet investment and a yield-generating business vertical. "This materially strengthens our valuation profile," Kenna stated, emphasizing GameSquare's unique positioning at the nexus of media, gaming, and digital assets.

Dialectic's approach aims to differentiate from conventional ETH accumulation strategies by focusing on active yield generation rather than passive appreciation.

Corporate Ethereum Treasuries Surge as Institutional Demand Hits $1.65B Monthly

Institutional accumulation of Ethereum has reached unprecedented levels, with ten treasury firms collectively acquiring 550,000 ETH worth $1.65 billion in just 30 days. Crypto entrepreneur Kyle Reidhead describes the demand as "insane," noting the trend shows no signs of slowing as new ETH treasury companies emerge weekly.

The buying spree could escalate to $2 billion next month and $3 billion thereafter, fueled by stablecoin expansion and favorable regulations. This institutional frenzy coincides with "Crypto Week" in the U.S., where major digital asset policy developments are expected.

Tornado Cash Founder's Trial Opens with High-Stakes Allegations

Jury selection concluded Monday in the trial of Tornado Cash founder Roman Storm, with opening statements revealing starkly divergent narratives. Prosecutors framed the case as a matter of national security, alleging Storm knowingly enabled money laundering for criminal entities including North Korea's Lazarus Group.

Assistant US Attorney Kevin Mosley opened with an emotional appeal, detailing how a New York woman lost $250,000 to scammers who laundered funds through Tornado Cash. The prosecution escalated claims to geopolitical scale, alleging the protocol processed $600 million for sanctioned entities. "He had the keys to the laundromat," Mosley asserted, painting Storm as an active enabler of financial crime.

Defense attorney Keri Axel countered with a portrait of Storm as a naive technologist. Characterizing him as a "coder, not a criminal," she emphasized his immigrant background and purported passion for blockchain's potential. The defense appears poised to challenge mens rea requirements, separating protocol creation from criminal intent.

BTCS Inc. Bolsters Ethereum Holdings with $44M Purchase Amid Market Rally

Ethereum's institutional adoption accelerates as blockchain technology firm BTCS Inc. acquires an additional 14,522 ETH worth $44.15 million. The strategic purchase coincides with ETH's recent price surge, signaling growing confidence in the asset's role as foundational infrastructure for the digital economy.

"Ethereum is going to be the financial rails that make the digital economy work," said BTCS CEO Charles Allen, articulating the thesis behind the company's accumulating position. The acquisition doubles down on ETH's network upgrades and expanding use cases as it cements its position as the leading smart contract platform.

Publicly traded companies continue entering crypto positions despite market volatility, with ETH emerging as a preferred institutional asset alongside Bitcoin. The latest purchase follows Ethereum's Dencun upgrade and growing layer-2 ecosystem, which have improved scalability while maintaining security.

Ethereum Reclaims $3K as Institutional Demand Surges

Ethereum has breached the $3,000 threshold for the first time since February, fueled by accelerating institutional adoption. U.S. spot Ethereum ETFs recorded weekly net inflows of 225,857 ETH—the highest since launch—signaling mounting confidence in regulated exposure to the asset.

Whale accumulation patterns mirror this bullish sentiment. Large holder netflows surged 163% over thirty days, with a 14.96% weekly uptick suggesting renewed positioning. Exchange reserves are dwindling as liquidation clusters FORM above $3,100, hinting at impending volatility.

The convergence of ETF inflows, whale activity, and technical consolidation around a psychological price level paints a fundamentally strong backdrop for ETH's next move.

Ethereum Defies Market Correction as SharpLink Becomes Top Corporate Holder

Ethereum (ETH) gained 2% on Tuesday, bucking the broader cryptocurrency market downturn. The resilience follows SharpLink Gaming's revelation of accumulating over 280,000 ETH in treasury holdings, surpassing the Ethereum Foundation's stash.

The Nasdaq-listed company acquired 74,656 ETH for $213 million last week, partially through an OTC deal with the Ethereum Foundation. With staking rewards included, SharpLink's position now stands at 280,706 ETH. The purchase was funded by $413 million raised through a share sale, with $257 million remaining for future acquisitions.

ETH's price held at $3,040 as it attempted to break through ascending trendline resistance. The asset continues to see institutional interest, with Ethereum ETFs attracting $1.3 billion in net inflows over seven trading days.

How High Will ETH Price Go?

Ethereum demonstrates strong technical and fundamental catalysts for upward movement:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $3,179.11 | Testing resistance |

| 20-Day MA | $2,704.38 | Strong support |

| MACD Histogram | -99.13 | Bearish momentum fading |

| Bollinger Upper Band | $3,205.29 | Breakout target |

Sophia from BTCC observes: "With institutional accumulation and technical alignment, ETH could challenge $3,500-$3,800 in the medium term if $3,200 resistance breaks."

border-collapse: collapse; width: 100%; margin: 20px 0;